Sitemap

A list of all the posts and pages found on the site. For you robots out there is an XML version available for digesting as well.

Pages

Posts

Future Blog Post

Published:

This post will show up by default. To disable scheduling of future posts, edit config.yml and set future: false.

Blog Post number 4

Published:

This is a sample blog post. Lorem ipsum I can’t remember the rest of lorem ipsum and don’t have an internet connection right now. Testing testing testing this blog post. Blog posts are cool.

Blog Post number 3

Published:

This is a sample blog post. Lorem ipsum I can’t remember the rest of lorem ipsum and don’t have an internet connection right now. Testing testing testing this blog post. Blog posts are cool.

Blog Post number 2

Published:

This is a sample blog post. Lorem ipsum I can’t remember the rest of lorem ipsum and don’t have an internet connection right now. Testing testing testing this blog post. Blog posts are cool.

Blog Post number 1

Published:

This is a sample blog post. Lorem ipsum I can’t remember the rest of lorem ipsum and don’t have an internet connection right now. Testing testing testing this blog post. Blog posts are cool.

portfolio

High-frequency Pricing Algorithm

Short description of portfolio item number 1

100 Years of FOMC Speak - An Application of LLMs on Monetary Policy Sentiment

Short description of portfolio item number 1

Weather and Consumer Behavior: Estimating Causal Demand Effects in Fashion E-commerce

This paper investigates the causal effect of weather conditions—temperature, rain, and sunshine—on consumer demand in the fashion e-commerce sector. Using a rich dataset combining daily sales and granular weather data from seven German cities over 2019–2024, a panel fixed-effects model isolates the impact of quasi-random local weather variations. The findings reveal that temperature has the most significant and persistent influence on sales, with warm days reducing daily sales by 1.1% on average, while rainy days slightly increase sales by 1.3% through higher platform engagement. Sunshine also reduces sales but to a lesser extent, with effects largely offset by increased purchasing intensity among active users. Seasonal and intertemporal analyses further highlight the dynamics of weather-driven demand shifts, with temperature effects proving more stable and economically relevant than those of rain or sunshine. These results underscore the importance of integrating temperature-driven demand patterns into forecasting and operational strategies to optimize inventory, marketing, and resource allocation. 1

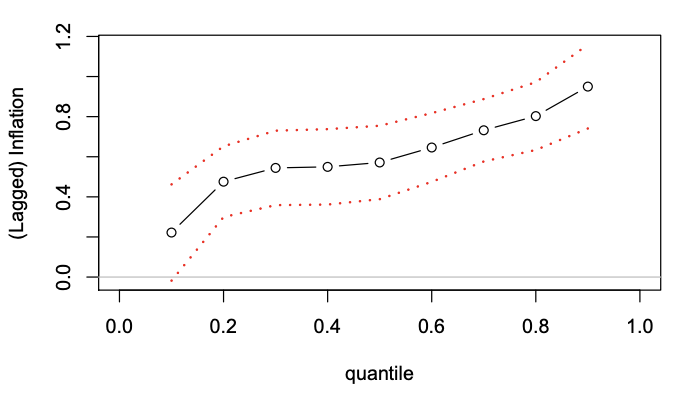

Quantile Instrumental Variable Panel Estimator

Applied econometrics seminar paper written during my stay at ENSAE Paris Tech.

Abstract: This project reviews the quantile regression dynamic panel data instrumental variables estimator (QRPIV) proposed by Galvao (2011). The method is summarised, main advances of the subsequent literature outlined and limitations of the approach assessed. We present a generic implementation of the estimator in R. The suggested method to estimate dynamic quantile panel models is applied to the question of determinants of inflation dynamics. We find that inflation shows heterogeneity in persistence across quantiles.

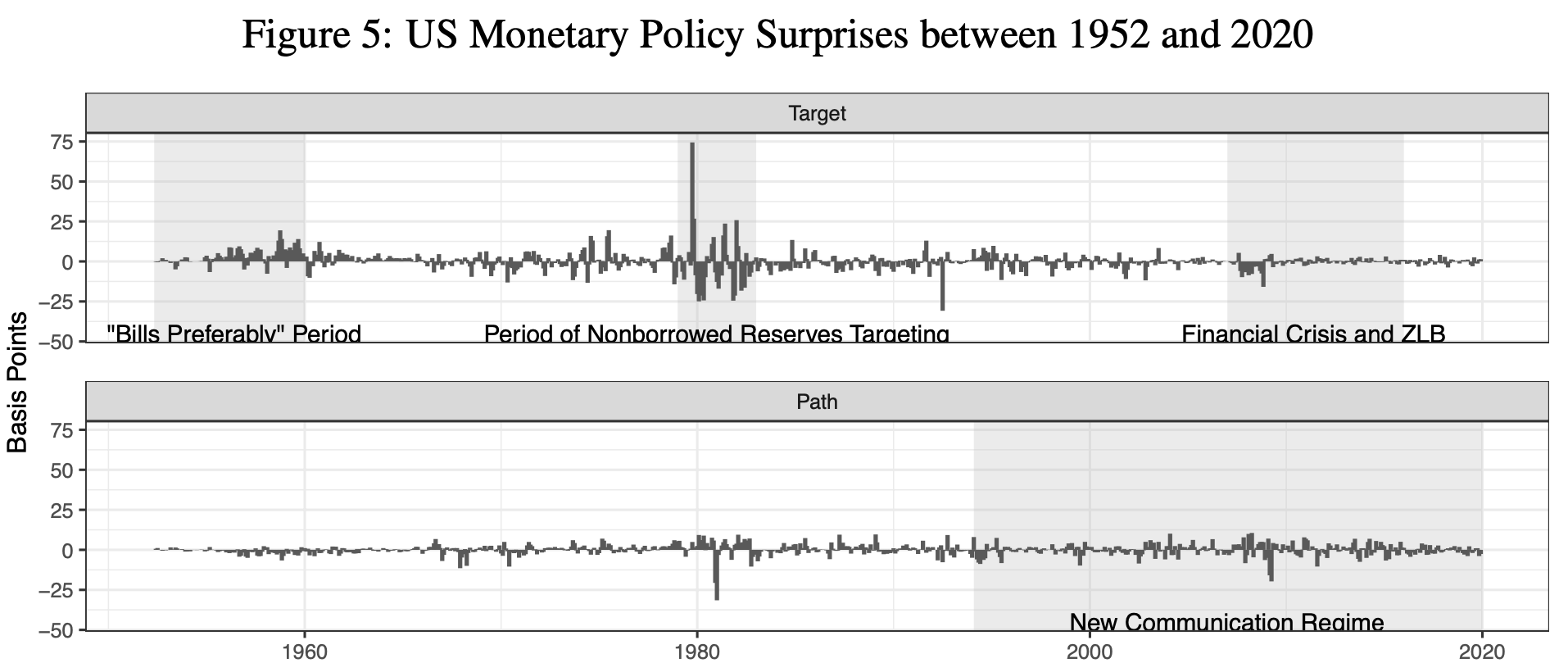

Monetary Policy Surprises, Economic Activity and Asset Prices

This project constitutes my master thesis at University of Bonn.

Abstract: This paper investigates the causal effects of monetary policy on asset prices and macroeconomic activity using a high-frequency identification strategy applied to newly digitized financial data spanning 1952 to 2020. By isolating monetary policy surprises from Treasury yield movements around policy announcements, the study disentangles classical shocks affecting current short-term rates from forward-path shocks influencing expectations of future short-term rates. The findings reveal significant shifts in monetary transmission over time, with forward-path shocks emerging as key drivers of corporate bond spreads and equity returns since the 1990s, while classical shocks primarily affect short-term yields. Moreover, contractionary monetary policy significantly reduces production, employment, and prices, with stronger effects during recessions than expansions. These results provide new insights into the evolving dynamics and state-dependent nature of monetary policy’s impact on financial markets and the broader economy.

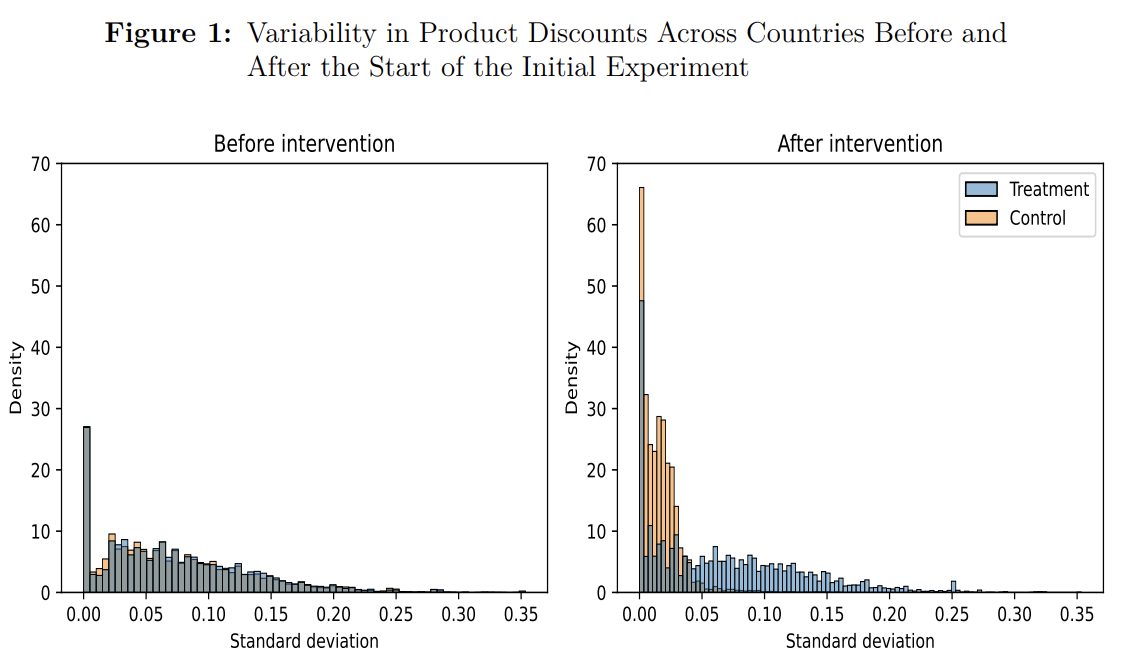

Human Machine Interaction in Pricing

This paper was the outcome of a long-term project at Zalando. Building on the insights from this project, I developed an algorithmic guardrail for human discounts as a solution of a multidimensional Knapsack problem. This human pricing guardail allowed for market tailored prices. The paper was presented at academic coneferences in Mannheim (ZEW), Berlin (VfS Jahrestagung), Düsseldorf (DICE), Rome (AI Conference), Max Planck Society. 1

Abstract: While many companies use algorithms to optimize their pricing, additional human oversight and price interventions are widespread. Human intervention can correct algorithmic flaws and introduce private information into the pricing process, but it may also be based on less sophisticated pricing strategies or suffer from behavioral biases. Using fine-grained data from one of Europe’s largest e-commerce companies, we examine the impact of human intervention on the company’s commercial performance in two field experiments with around 700,000 products. We show that sizeable heterogeneity exists and present evidence of interventions that harmed commercial performance and interventions that improved firm outcomes. We show that the quality of human interventions can be predicted with algorithmic tools, which allows us to exploit expert knowledge while blocking inefficient interventions.

Outlier Detection in Experimentation

Short description of portfolio item number 1

The Expected, Perceived, and Realized Inflation of US Households Before and During the COVID19 Pandemic

A research project I contributed to during my stay at University of Chicago - Booth School of Business. I was responsible for data preparation and empirical analysis.

Abstract: Using matched micro-data on the spending of households and their macroeconomic expectations, we study the link between the realized inflation of households in their daily shopping and their perceived and expected levels of inflation both before and during the pandemic. As the pandemic spread across the USA, disagreement among US households about inflation expectations surged along with the average perceived and expected level of inflation. Simultaneously, realized inflation at the household level became more dispersed. During the pandemic, low income, low education, and Black households experienced a larger increase in realized inflation than other households. Dispersion in realized and perceived inflation explains a large share of the rise in dispersion in inflation expectations. Finally, households jointly revised their inflation and unemployment expectations during the pandemic, consistent with a supply-side view of the pandemic.

Beliefs and Portfolios: Causal Evidence

A research project I contributed to during my stay at University of Chicago - Booth School of Business. I was responsible for data preparation and empirical analysis.

Abstract: We causally test alternative theories of expectation formation and asset pricing. Using a randomized information experiment we show overreaction is a key feature of individuals’ belief formation. Individuals excessively extrapolate past returns and earnings growth into future returns. The average response to the price-earnings ratio is opposite to the academic consensus and individuals’ reaction to stock market news depends on their perceived importance. Conditional on their beliefs, individuals’ sensitivity of risky portfolio shares is consistent with the standard Merton model of portfolio choice. Our evidence suggests belief overreaction and heterogeneous subjective mental models as key ingredients to asset pricing models.

publications

Paper Title Number 1

Published in Journal 1, 2009

This paper is about the number 1. The number 2 is left for future work.

Recommended citation: Your Name, You. (2009). "Paper Title Number 1." Journal 1. 1(1).

Download Paper | Download Slides

Paper Title Number 2

Published in Journal 1, 2010

This paper is about the number 2. The number 3 is left for future work.

Recommended citation: Your Name, You. (2010). "Paper Title Number 2." Journal 1. 1(2).

Download Paper | Download Slides

Paper Title Number 3

Published in Journal 1, 2015

This paper is about the number 3. The number 4 is left for future work.

Recommended citation: Your Name, You. (2015). "Paper Title Number 3." Journal 1. 1(3).

Download Paper | Download Slides

Paper Title Number 4

Published in GitHub Journal of Bugs, 2024

This paper is about fixing template issue #693.

Recommended citation: Your Name, You. (2024). "Paper Title Number 3." GitHub Journal of Bugs. 1(3).

Download Paper

talks

Talk 1 on Relevant Topic in Your Field

Published:

This is a description of your talk, which is a markdown files that can be all markdown-ified like any other post. Yay markdown!

Conference Proceeding talk 3 on Relevant Topic in Your Field

Published:

This is a description of your conference proceedings talk, note the different field in type. You can put anything in this field.

teaching

Teaching experience 1

Undergraduate course, University 1, Department, 2014

This is a description of a teaching experience. You can use markdown like any other post.

Teaching experience 2

Workshop, University 1, Department, 2015

This is a description of a teaching experience. You can use markdown like any other post.